Neuroeconomics, a fascinating interdisciplinary field, merges insights from neuroscience, psychology, and economics to unravel the complexities of human decision-making. By examining the neural underpinnings of economic behavior, it offers a window into how we assess risks, process rewards, and navigate social dynamics. This unique approach is not just about theory—it has profound real-world applications in marketing, policymaking, healthcare, and financial markets. Let’s explore how neuroeconomics is shaping our understanding of human behavior.

Table of Contents

Introduction to Neuroeconomics

At its core, neuroeconomics is a multidisciplinary field designed to explore how people make decisions. By integrating neuroscience, psychology, and economics, it dives deep into the brain’s decision-making processes. Neuroeconomics doesn’t just rely on economic models or psychological theories—it uses cutting-edge neuroscience tools like functional MRI (fMRI) and EEG to study brain activity in real time. These insights help decode why we make the choices we do, from buying a product to investing in stocks or even deciding to trust someone.

This groundbreaking field has already reshaped how we view human behavior, challenging traditional economic models that assume purely rational decision-making. Instead, neuroeconomics reveals the fascinating interplay between rational thought and emotional impulses, offering tools to design better policies, products, and interventions.

Neuroeconomics Definition: A Breakdown of Its Key Components

To truly grasp neuroeconomics, we must first examine its foundational elements. The field combines three disciplines, each contributing essential insights to the puzzle of human behavior.

Neuroscience: Mapping the Brain’s Role in Decisions

Neuroscience provides the tools to study the brain’s structure and activity. Technologies like fMRI and EEG allow researchers to identify which brain regions activate during specific decision-making processes. For instance:

- Risk assessment involves the amygdala, known for processing fear and uncertainty.

- Reward evaluation is linked to the striatum and prefrontal cortex, regions tied to pleasure and planning.

- Impulse control relies heavily on the prefrontal cortex, which regulates emotions and delayed gratification.

These insights explain why people may behave irrationally under stress or temptation, bridging gaps left unexplained by traditional economics.

Psychology: Understanding Cognitive and Emotional Influences

Psychological theories provide the foundation for understanding cognitive biases and emotional processes. For instance:

- Fear and anxiety can skew investment decisions, leading to risk aversion during market downturns.

- Past experiences and memories often shape consumption patterns.

By exploring these elements, neuroeconomics explains why people frequently deviate from rational behavior and how emotions like empathy or anger influence economic choices.

Economics: The Framework of Incentives and Trade-Offs

Traditional economics focuses on resource allocation, incentives, and trade-offs. Neuroeconomics enhances these models by incorporating insights from neuroscience and psychology. For instance:

- How do biases like loss aversion affect financial decisions?

- Why do people sometimes ignore rational cost-benefit analyses?

This interdisciplinary blend creates a more holistic framework for understanding behavior, far beyond the assumptions of pure rationality.

What Is Neuroeconomics Studying? Key Areas of Research

The scope of neuroeconomics is vast, covering areas that delve deep into human psychology and economic behavior. Here are some of the major research areas shaping this field:

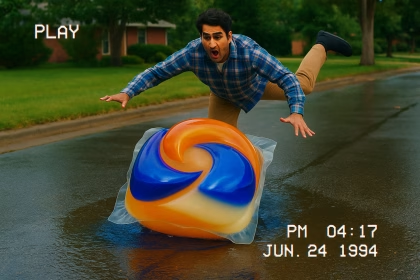

Decision-Making Under Risk and Uncertainty

Why do we shy away from certain risks while embracing others? Neuroeconomics studies the brain’s response to uncertainty, shedding light on phenomena like:

- Loss aversion, where losses are valued more than equivalent gains.

- Behavioral patterns in gambling, insurance, and investing.

This research provides actionable insights for designing better financial tools and risk communication strategies.

Reward Processing: Why Rewards Drive Behavior

The brain’s reward system, involving areas like the striatum, plays a critical role in shaping preferences. Neuroeconomics studies how we evaluate rewards, helping explain consumer behavior, addiction, and even savings habits.

Intertemporal Choices: Balancing Now vs. Later

Why do people struggle with long-term planning, like saving for retirement? Neuroeconomic studies show that:

- The brain treats immediate and future rewards differently, often leading to short-term bias.

This research has significant implications for designing programs that encourage long-term thinking, from education to retirement savings.

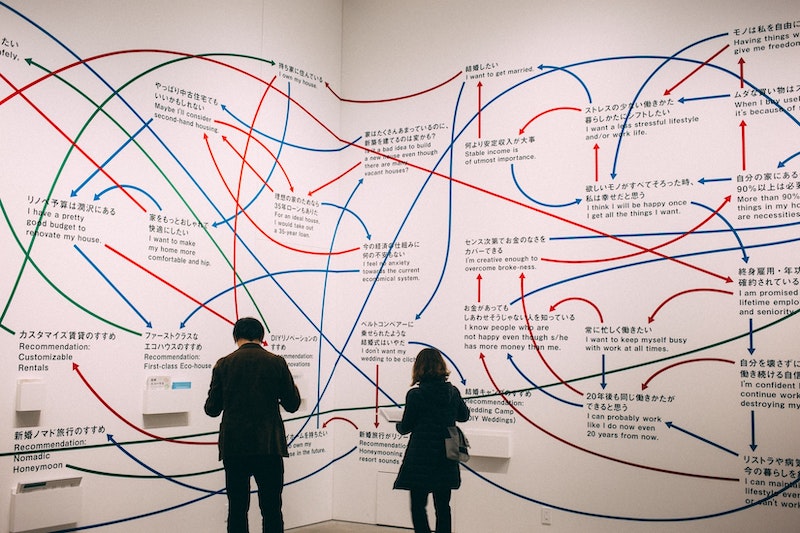

Social Decision-Making: The Role of Trust and Cooperation

Trust, empathy, and social norms are critical in economic decisions. Neuroeconomics investigates how social dynamics influence behavior in situations like negotiations, teamwork, and market interactions.

Applications of Neuroeconomics in the Real World

Neuroeconomics is far from being a purely academic pursuit. Its real-world applications are revolutionizing industries and improving lives.

Marketing and Consumer Behavior

Companies are leveraging neuroeconomics to decode what drives purchasing decisions. By analyzing how people process rewards and emotional triggers, businesses can:

- Create compelling advertisements.

- Design products that resonate on a subconscious level.

This leads to more effective campaigns that align with consumer psychology.

Policy Development

Policymakers can use neuroeconomics to design interventions that account for human irrationality. Examples include:

- Retirement savings plans that account for loss aversion.

- Public health campaigns that leverage emotional appeals to influence behavior.

Improving Healthcare

Neuroeconomics offers significant potential for healthcare, particularly for conditions involving impaired decision-making, such as:

- Addiction: Understanding reward-processing deficits can inform treatment strategies.

- Obesity: Insights into impulse control can help develop more effective interventions.

Financial Markets

The irrational behaviors that fuel market bubbles and crashes can be better understood through neuroeconomics. This field provides tools to design training programs for investors and develop systems that minimize emotional decision-making in trading.

Challenges and Future Directions

While neuroeconomics holds immense promise, it is not without challenges:

- Ethical concerns: The use of neuroscience in influencing consumer or voter behavior raises questions about manipulation.

- Complexity of the brain: Despite advances, understanding the full complexity of neural networks remains a monumental task.

However, as technology evolves and interdisciplinary collaboration grows, the potential for neuroeconomics to transform industries continues to expand.

Conclusion

Neuroeconomics provides an unprecedented view into the science of decision-making, blending neuroscience, psychology, and economics into a cohesive framework. It challenges traditional models of rationality, offering deeper insights into how emotions, biases, and social dynamics influence choices. As this field grows, it promises to revolutionize industries ranging from marketing to policymaking and healthcare, offering tools to improve human welfare by aligning strategies with how people truly think and act.

By studying the brain’s role in decision-making, neuroeconomics helps us answer fundamental questions about human behavior—and its potential applications are only beginning to be realized.

FAQs

What is neuroeconomics?

Neuroeconomics is an interdisciplinary field that combines neuroscience, psychology, and economics to study decision-making processes and economic behavior.

How does neuroeconomics differ from traditional economics?

Traditional economics assumes rational decision-making, while neuroeconomics incorporates insights from psychology and neuroscience to explain emotional and irrational behaviors.

Why is neuroeconomics important?

Neuroeconomics helps improve policies, products, and interventions by providing a deeper understanding of how decisions are made.

What tools are used in neuroeconomics research?

Researchers use tools like fMRI, EEG, and neuroimaging to study brain activity during decision-making processes.

How does neuroeconomics apply to marketing?

Neuroeconomics helps businesses design more effective campaigns by understanding consumer behavior and subconscious motivations.

What are the ethical challenges of neuroeconomics?

The use of neuroscience to influence behavior raises ethical questions about manipulation and consent.

Read Further

References

- Camerer, C., Loewenstein, G., & Prelec, D. (2005). Neuroeconomics: How neuroscience can inform economics. Journal of Economic Literature, 43(1), 9-64.

- Glimcher, P. W., & Fehr, E. (Eds.). (2013). Neuroeconomics: Decision making and the brain. Academic Press.

- Kahneman, D. (2011). Thinking, fast and slow. Farrar, Straus and Giroux.

- Thaler, R. H. (2016). Misbehaving: The making of behavioral economics. W. W. Norton & Company.

- Kable, J. W., & Glimcher, P. W. (2007). The neural correlates of subjective value during intertemporal choice. Nature Neuroscience, 10(12), 1625-1633.

- Schultz, W. (2015). Neuronal reward and decision signals: From theories to data. Physiological Reviews, 95(3), 853-951.

- Berns, G. S., Laibson, D., & Loewenstein, G. (2007). Intertemporal choice–toward an integrative framework. Trends in Cognitive Sciences, 11(11), 482-488.

- Rilling, J. K., & Sanfey, A. G. (2011). The neuroscience of social decision-making. Annual Review of Psychology, 62, 23-48.

- Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297-323.

- Plassmann, H., Ramsøy, T. Z., & Milosavljevic, M. (2012). Branding the brain: A critical review and outlook. Journal of Consumer Psychology, 22(1), 18-36.

- Benartzi, S., & Thaler, R. H. (2007). Heuristics and biases in retirement savings behavior. Journal of Economic Perspectives, 21(3), 81-104.

- Lo, A. W., Repin, D. V., & Steenbarger, B. N. (2005). Fear and greed in financial markets: A clinical study of day-traders. American Economic Review, 95(2), 352-359.

- Bickel, W. K., & Marsch, L. A. (2001). Toward a behavioral economic understanding of drug dependence: Delay discounting processes. Addiction, 96(1), 73-86.

- Glimcher, P. W., Fehr, E., Camerer, C. F., & Poldrack, R. A. (2013). Introduction to Neuroeconomics: Decision Making and the Brain. Academic Press.

- Levy, D. J., & Glimcher, P. W. (2012). The root of all value: A neural common currency for choice. Current Opinion in Neurobiology, 22(6), 1027-1038.