A new real-estate law in Denmark requires banks and mortgage companies to present two “mandatory front pages” to every loan proposal, containing five key figures which will help give borrowers the overview they need to choose the right loan. This is a direct result of years of focused behavioral economic research and analysis by the Danish Competition and Consumer Authority, powered by iMotions.

At iMotions, we love when our clients create a positive impact with their research and bring about change. In this particular instance, we are thrilled because we believe that there is no greater impact than changing the law of a country for the better, and that is exactly what happened.

Choosing the right loan when you are buying a house or an apartment can be a confusing and daunting task. Anyone who has been through the process of gathering information and offers from various banks can most likely attest to that. Most homeowners can most likely also agree that the process could and should be made easier and more transparent, and a new law in Denmark is setting out to do exactly that.

The new law requires banks and mortgage companies to present two “mandatory front pages” to every loan proposal, containing five key figures which will help give borrowers the overview they need to choose the loan that is right for them.

The five key figures mandated by the new law are

1.

Median cost, before tax, through the first twelve months

2.

The banks’ fee for creating the loan

3.

Added mortgage cost through the first twelve months

4.

Total amount to be paid back (loan + interest)

5.

The yearly cost to uphold the loan

When presented with these five key figures, borrowers become much better equipped to choose the right loan and challenge the lender with the right questions, forcing the lender to always be transparent and consistent in their loaning policies.

The groundwork for this new law was made by The Danish Competition and Consumer Authority. It is a government office charged with looking after the interests of consumers and its philosophy is that consumers should be provided with actionable data which enables them to make the best possible decisions. The new law and the choice to implement the mandatory front pages containing the five key figures are the direct results of years of focused behavioral economic research and analysis by the Competition and Consumer Authority. The research was an endeavor in which they have used the iMotions Software Suite to perform a UX study on navigating online loan proposals.

Methodology

This particular experiment was carried out by iMotions back in 2016 and had 120 respondents. For the experiment, we used Facial Expression Analysis (FEA) to measure the level of frustration in the respondents when trying to complete their tasks of deciphering loan proposals and Screen-Based Eye Tracking to observe where the respondents were looking on the screen.

An important part of the methodology was the selection criteria for the respondents. It was very important that they represent the broadest spectrum of the population in the best possible way. Therefore, It was decided that no respondents could have a background in finance or education in economics, as the current state of practice of framing loan proposals, was unlikely to confuse or deter anyone with such a background. The respondents received one caveat before starting the tests, which was to not choose the cheapest loan unless it was the one that would be the best fit for them, which was what they should focus on.

Experiment

Testing the impact of the new mandatory front

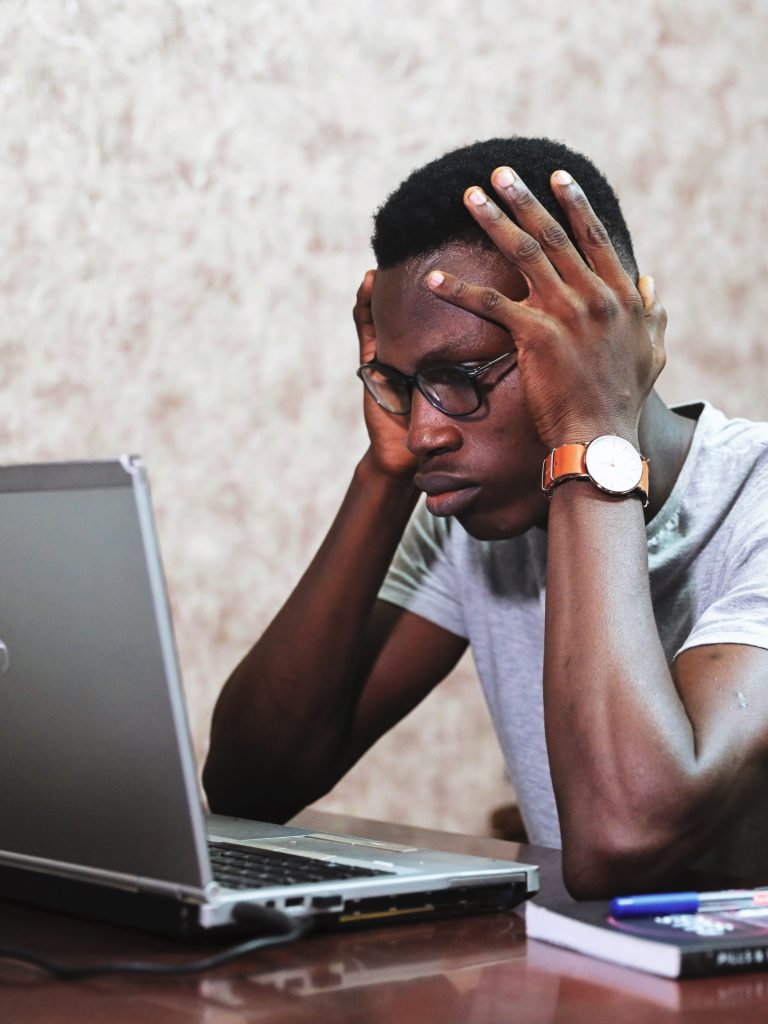

The experiment was divided into two parts. The first part was a test of comprehensibility, which set out to test the impact of the mandatory front pages on the borrowers’ ability to understand the loan offer presented to them. The second part was a test of comparability, which gauged the impact of the mandatory front pages on the borrowers’ ability to compare several loan proposals when presented simultaneously.

In the first test, respondents were asked to read through a loan proposal both with the new mandatory front pages and without. A week transpired between the two parts of the test. After reading the proposal, the respondents were asked to give a subjective evaluation of how understandable the proposal was. Following that the respondents were asked to objectively answer what the interest rates and monthly payments in the proposal were.

The conclusion was that only around half of the respondents were able to give the correct answers to the objective questions regarding the key figures of the loan proposal when the mandatory front pages were left out. On the contrary, upwards of 90% of the respondents could accurately answer the same questions when the mandatory front pages were included.

For the second part of the experiment, a group of respondents was asked to compare three different loan proposals that all featured the mandatory front pages. A second group received the same task where the mandatory front pages were left out. Both groups were then asked to first give a subjective evaluation of how it felt to compare the loan proposals, and then to answer questions about objective figures such as yearly added cost and monthly costs of the loans.

As is often the case when faced with information from a bank, both groups showed signs of frustration on the second part of the experiment. However, the group that did not have the key figures from the mandatory front pages showed significantly higher levels of frustration than the other group.

This is a perfect example of the value, strength, and transformative power of human behavior research. By measuring and interviewing a sample pool of the very same consumers that stand to benefit from this new transparency you drive positive change, in this case, to the entire population of a country.

For more information about this experiment and the work with creating the groundwork for the new mortgage law, go here. NB: the site is in Danish.

Are you interested in learning more about the science and methodology behind this study, you can download our UX and Usability brochure below.

Download iMotions

UX Brochure

iMotions is the world’s leading biosensor platform.

Learn more about how iMotions can help you with your UX work and research